Recent years have been full of uncertainties for everyone all over the world, despite that, doing business in Estonia has only got smoother and safer.

Estonia has come a very long way since restoring its independence. Nowadays, the republic is the birthplace of many global business ideas and is a great environment to start a company in general. This is mainly because of the simple tax system, low tax duties, impressive technological advancements, and our innovative government.

Incorporate is ready to help you! Please feel free to reach out to us if you would like to get more information about any of our company formation & management services or accounting services.

Here are some statistics to give you a general idea and some perspective about the business climate in the Republic of Estonia:

- 1st in the International Tax Competitiveness Index in 2022, and so for the 9th year in a row.

- 3rd in the Global Cybersecurity Index and 1st in the European Union in 2022.

- 4th in the World Press Freedom Index in 2022.

- In 2022, according to Statista, the digital republic of Estonia ranks 7th in Economic Freedom Index, right after Taiwan.

- 13th in the Corruption Perceptions Index in 2021.

- 18th in the Ease of Doing Business Index in 2019.

- According to Freedom House, the republic has a Global Freedom Score of 94/100, and Internet Freedom Score of 94/100.

Like we said, running a company in Estonia has never been easier or safer! Follow along as we explain to you in-depth why exactly this small European country has got these rankings, and what are the real benefits of having your own company there.

Entrepreneurs’ paradise

The Republic of Estonia might be small, but it does not seize to amaze with its innovative ideas and courage to try out new things. In fact, the republic is the first country in the world to offer e-Residency, and the idea is one of a kind.

Also, what is amazing about the Estonian infrastructure is how the entire system works – you can do everything online, and there is internet virtually everywhere, even in the forest. It is an ecosystem that is being built brick by brick by the government, and it is collaborating with many independent businesses. You can even run companies there with no actual office space.

So, it is no surprise that this republic is home to many giants like Skype, Wise (Get first 3 transfers up to €5,000 for free) and Bolt. As time goes on, there will certainly be many more corporations to add to the list – maybe even yours!

Estonian e-Residency — a digital identity available for anyone

Estonian e-Residency can be described as having a digital identity card that grants you access to Estonia’s private- and public sector’s services — no matter where you are located.

The Estonian Government launched the e-Residency program in 2014. The program made it easier for people who are not Estonian citizens nor its residents, to join its economy and to start their own companies. The e-Residency card enables people to open their very own Estonian business, open an Estonian bank account, and do their taxes completely remotely. It is not just individuals from the European Union that benefit from being e-residents; it is accessible for everyone around the globe – creating a gateway for doing business within the EU.

In 2017, the local government launched a start-up visa program that is supporting Estonian start-ups with non-EU founders to start their company there and to run it in Estonia. This led to a massive increase in start-ups and their impact on the local economy.

In 2020, the Estonia launched a new visa. This time they direct it towards digital nomads, who earn a steady income using the internet and can work remotely.

Starting and managing your business is simple and effective

Like we mentioned before, setting up and managing your Estonian business is a process that can be done online. This is thanks to the Estonian government’s efforts to minimise bureaucracy and the many e-services that entrepreneurs can use to keep their company running smoothly. The e-residency card is the key to the entire system of the republic. Once you have got it, the rest is easy.

When starting your Estonian company, there are some things that you need to decide. First you must decide on the type of business that you wish to establish and if you will be running the company in Estonia or from abroad. Your options are to start a sole proprietorship (FIE), a private limited company (OÜ) or a public limited company (AS).

All these options have different requirements for the minimum share capital, the annual reports, board members, etc. You must think of these details before you can complete your company formation process. Eventually your company is registered on the e-Business Register, where you can see and change data related to your corporation.

If you have your digital identity, you can talk to a banking provider to open a bank account. Though this might be tricky sometimes because of their own strict business regulations. Once you have your bank account, you can pay in your share capital, have your company’s debit card, and take part in commerce.

Sometimes these processes can be very complicated and lengthy. Our Incorporate in Estonia team offers services to entrepreneurs like you with setting up and managing your own Estonian company – making it as simple as possible. Feel free to reach out!

Low and competitive tax rates

Estonia has become particularly attractive for foreign investors and non-EU business owners, who are interested in creating their own EU company or expanding their current businesses to Europe. One reason might be that the Estonian business taxes are lower compared to Central and Western Europe countries.

- The country was ranked the first in tax competitiveness thanks to a combination of 3 key features of its tax code set by the legislation and the tax office.

- 0% corporate income tax rate on reinvested profits and profits retained in the company, and 20% upon dividend distribution and even lower in some cases.

- 20% flat rate on income and 33% tax on social contributions.

- Property tax where only the value of the land is taken into account (rather than the value of the property itself or the capital).

- Estonia has implemented a territorial tax system that states that all foreign profits earned by domestic corporations are exempt from domestic taxation.

Skilled workforce

Estonia believes in lifelong learning, and it begins at an early age. The local children start their learning journey at age 3, when they go to kindergarten. Next, they are off to primary school, which the local law requires them to finish.

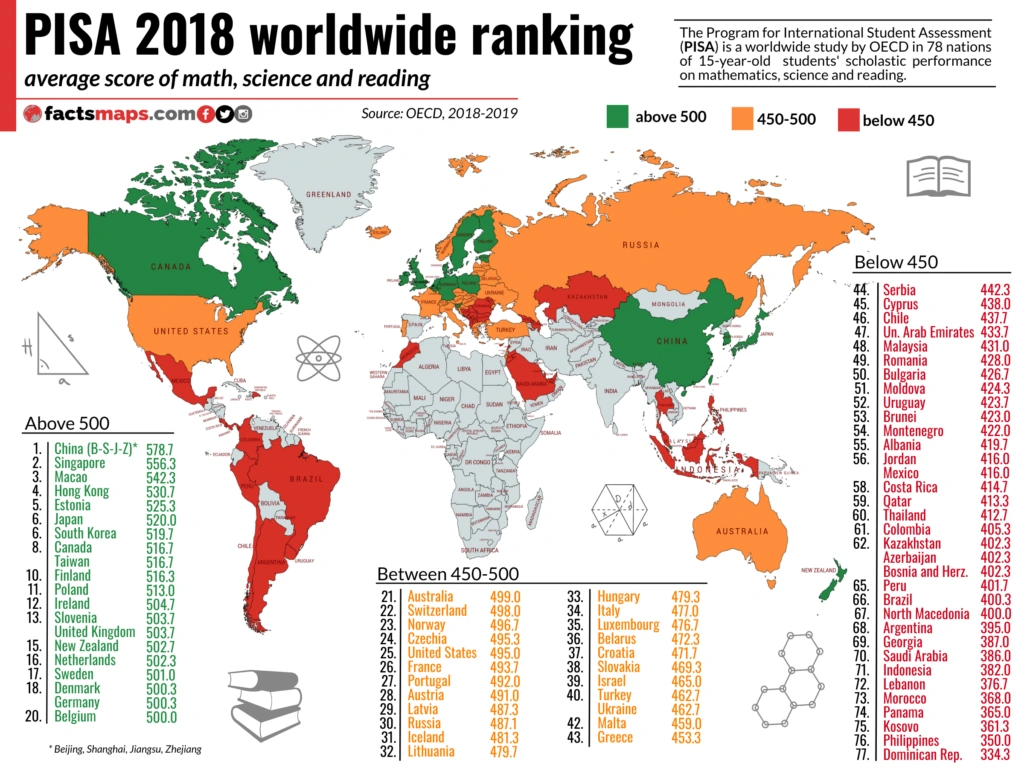

According to the Pisa tests from 2018, which measure 15-year-olds’ abilities to apply their learned skills, the country ranked the 1st in Europe and the 5th in the whole world. The government’s focus on early years education and its quality has paid off.

As of higher education, the nation has 19 institutions that welcome locals and students from all over the world. Currently, the most popular areas of study are business, law, arts, and IT. This makes Estonia a perfect place for you to start your own company and expand while hiring well educated employees and partners.

Strong government and legal system

A country where digital signatures with ID cards and digital residence cards are forms of online identification, there has to be an innovative and flexible government with good legislation behind it. In fact, the local and foreign policies favour entrepreneurship and foreign investors have equal rights with local entrepreneurs.

Since regaining independence, the local government has concluded 20 investment protection treaties that are currently in force and 62 double taxation avoidance treaties with different countries around the world. These agreements have improved international trade and investments, thus making the business environment better for all parties present and involved in doing business in Estonia.

The republic divides the local legal system into public and private law. Whereas private law comprises civil law and commercial law. While the public law comprises criminal law, financial law, administrative law, constitutional law, international law, and procedural law.

The parliament represents the Estonian people and is the body that has legislative power. Whereas the government has the executive power. The court, and the court only, administers the justice, making it completely separate from other authorities and their potential influence.

Estonia is a startup nation

Estonia is a catalyst for the digital revolution, and like mentioned earlier, the support from its government has helped to create it. The republic has a strong start-up ecosystem that has been moulded by their skilled workforce, business friendly regulations, extensive collaborations, and by many investors and accelerators. As of May 2022, there are 1365 start-up businesses in Estonia, and their combined revenue in the first quarter of 2022 reached €417 million.

Click here to read more about start-ups in Estonia.

Advanced cyber security

Obviously, cyber security plays a huge role in the nations’ infrastructure because they store all the government and residents’ data in the cloud.

A breach in the system that can easily be accessed with just ID cards and e-Residency cards might be a major compromise to data protection and fraud carried out by cybercriminals. Keeping that in mind, it is no surprise that Estonia is the home for the NATO Cooperative Cyber Defence Centre of Excellence and for other key personal data protection and online fraud prevention institutions in the world.

Our country also ranks 3th in Global Cybersecurity Index and 1st in the EU, which is very impressive! Also, Estonia has been successfully defending itself against cyberattacks since 2007.

Global fintech centre

If you already have heard something of this country, we are sure that you have also heard about some famous Estonian companies that are out there in Fintech – the most famous being Wise (Get first 3 transfers up to €5,900 for free).

Our country has over 20 years of experience in Fintech and currently there are over 80 Fintech companies/start-ups in the country. All of this has made the country 99% cashless—only 1% of transactions happen using cash.

The fact that Estonia has been a very early adopter of technological solutions has also pushed Estonia to be one of the pioneers in innovation with virtual currency companies and providing those companies a legal framework.

Blockchain economy

When Blockchain launched to the public, our digital republic jumped on board to integrate this secure ledger system to its information infrastructure which in turn has also boosted the adoption of virtual currency by entrepreneurs.

Estonia was actually one of the first countries in the world to start regulating and providing financial acivity licenses for virtual asset service providers (VASPs). First licenses for VASPs were provided in 2017 when the government approved a legislation that specified the meaning of virtual currency services and made it an activity which must be supervised.

Only in 2018, the Estonian Financial Intelligence Unit (FIU), which is an institution responsible for the supervision of VASPs, gave out 612 virtual currency exchange licenses and 525 virtual currency wallet licenses.

Since March 2022, the legislation for VASPs in Estonia gotten a lot stricter due to the government noticing a very high risk for money laundering and terrorist financing activities and pushed efforts for the industry to become more transparent and secure.

e-Health blockchain ecosystem

Blockchain technology was also integrated into the national healthcare information system and was made a part of e-Estonia’s system. The e-Health system, as it is called, enables to digitise all health records and to access them in an instant at all times. Today, 95% of all medical data, that is created at any health institution, is digitalized and accessible online 24/7.

The Estonian IT infrastructure had its beginning in 2001 with X-Road, which was the country’s ambition to create a centralized authorization system, which will make data more accessible to the citizens, state officials and entrepreneurs. Since its success, X-Road is what laid the road to the country’s current state of IT.

Global hub for ecommerce

Not only is Estonia the home for Fintech and blockchain companies, but it has also become a global hub for many e-commerce solutions and companies.

According to Statista, overall revenue in eCommerce in the nation is projected to reach US$998.6 million by the end of 2022. This huge number is made possible by many e-commerce and international business enablers that offer improved security, confidence for customers of online businesses and the opportunity for international entrepreneurs to establish their own business in Estonia.

In addition, e-commerce providers like Linnworks and Erply, which were born in our digital republic, have now turned into big international businesses that help to create websites for independent freelancers and small businesses. This adds even more value to the local e-commerce scene by enabling local and international entrepreneurs to establish their own stores that can sell various goods.

Strategic location between Nordic, Baltic, EU, and CIS countries

Estonia, with its accessible location in the Baltic countries, is the perfect strategic location for your company.

Many big and small business owners may say that the nation offers great physical access to the Nordic, Baltic, Commonwealth of Independent States (CIS), and other European Union countries around it. Thus, improving trade within and outside of the EU borders.

To compliment any logistical needs, there are many businesses Estonia that can help you with your supply chain management by offering transportation, storage and even manufacturing, making your business run smoother and more efficiently.

Further benefits can be found with the help of analytics, A.I. and robotics provided by innovative start-up companies in Estonia.

Need help with navigating within the Estonian business lanscape?

If you are about to establish your own business in Estonia or already operating here for some time, Incorporate is here for you! We can offer professional services and advice which is supported by our long experience with local and international matters.

Please feel free to reach out to us!

FAQ

How can I start a business in Estonia?

Essentially, there are 3 different ways that you can start a business in Estonia:

- Having an e-Residency card and using to create a company through the Estonian e-Business Register or using a corporate service provider like Incorporate, who can help register your business in one business day. However, if you plan to establish a public limited liability company or a company with non-monetary funds, electronic establishment is not possible.

- Using the Power of Attorney, which enables us to establish a company on your name at a local notary. The timeframe to establish a company with this method can be larger, as the written authorisation and the mailing of documents might take some time. However, it is a very effective method, for which we offer services as well.

- The third method is to visit an Estonian notary during your visit to Estonia, which can also be very fruitful as it offers a great opportunity to explore our beautiful country.

If you are interested in finding out more about establishing a company in Estonia, please click here.

What is the tax rate in Estonia?

As in every country, in Estonia there are different tax rates for different situations and purposes.

When talking about businesses, the Estonian corporate income tax rate is 0%, however, this applies to retained and reinvested profits. In case of dividend pay-outs, all resident companies and permanent establishments of foreign entities are taxed with 20%. Also, the general VAT rate is 20%, however the rate may change based on the products or services you offer.

On a personal level, companies who pay salaries to Estonian employees will need to withhold income tax of 20% and 33% of social tax and pay it to the state on a monthly basis.

If you are interested in learning more about taxes for companies in Estonia, please click here.

What types of corporate entities are there in Estonia?

There are many corporate entities that are available for creation in Estonia, all of them have their own pros and cons. Here is a general overview of them:

FIE – which is the Estonian equivalent of a sole proprietor. This company can be established without starting capital, and the owner is personally liable for all liabilities.

OÜ – is the private limited liability company and the most popular incorporation type as it offers more protection and has a preferable management structure. The required starting capital is €2,500 and can be established even without initial contribution.

AS – the public limited liability company where the shareholders are not personally responsible for the liabilities of the company. Also, an AS must be established with at least €25,000.

TU and UU – the two Estonian partnership companies, both of which can be established with no starting capital; however, the amount can be set within the starting documents.

In case you would like to find out more about the types of companies you can establish in Estonia, please click here.