Every year, as the fiscal year has ended and the first month of the year has passed, starts the awaited income tax return filing in Estonia. Hundreds of thousands of people submit their tax returns, hoping to get back some of the taxes that they paid during the year.

Some, however, end up being disappointed as they have to pay the state money instead of receiving it. The result of your declaration is affected by many factors and that is why it is of utmost importance that you are aware of how to file your documents and which ones you need to submit in the first place.

Who is required to fill the tax return form?

The tax return forms have to be filled by almost all Estonian tax residents, although there are some exceptions. Also, some non-Estonian tax residents are required to fill in some forms depending on their situation and relation with Estonia. A person is considered an Estonian tax resident if they are domiciled in Estonia or have been physically present in the country for at least 183 days for 12 consecutive calendar months.

Incorporate is ready to help you! Please feel free to reach out to us if you would like to get more information about any of our company formation & management services or accounting services.

Estonian tax residents

Any natural person, who is considered an Estonian tax resident, must file an income declaration about their last taxation period (from January to December). More specifically, a declaration must also be submitted by:

- sole proprietors (FIE businesses) and they must submit form A and form E.

- people, who have gained income like for employment, dividends, pensions, etc., from abroad. Also, one must declare income that is not taxed in Estonia according to Tax Treaties.

- people who owned shares, stocks, votes or the right to profits of a legal person located in a low-tax territory during the fiscal year. They must submit form MM or form MM annex. One must declare this even if the legal person earned no income.

- people whose loss from transferring securities exceeds the gain from transferring securities during the taxation period and who in the subsequent years wish to deduct their loss from their future profits from transferring securities.

- people who have made contributions to or withdrawals from the investment account specified in the Income Tax Act §17 during the taxation period.

- people who wish to declare additional tax-free income for their spouse.

Meanwhile, people who are Estonian tax residents and receive income for which there is no need to pay extra taxes do not need to declare their income. The same goes for those whose annual income has been below the tax-free limit of €6000. In case a person is not required to declare their income, they may still do it for deductions if they have paid for some training courses, paid interest on their mortgage, etc.

Non-Estonian tax residents

In case you are not an Estonian tax resident, but you own/manage an Estonian business or an investment fund that derived income in Estonia, you must submit a declaration of earnings to the local tax office. According to the Estonian Tax and Customs Board, you must declare your income if:

- you are a non-resident and have profited from transferring property and you have not paid income tax on those gains. Then you must submit the form V1.

- you are a non-resident sole proprietor or have a non-resident legal entity that does not have a permanent establishment in Estonia and has income that derived from Estonian sources. Then you must submit the form E1.

- you are a non-resident and have received taxable income such as for employment and service, remuneration of being a member of a controlling or managing body, commercial lease or royalties, interest, dividends, other taxable income (pensions, scholarships, grants, cultural, sports and scientific awards, benefits, gambling winnings), and/or income as an artist or an athlete according to the Income Tax Act. In this case, you must submit the form A1.

Important dates

Every year in February, people start eagerly waiting for information about when they can start submitting their tax return declarations, and when they will receive their money back, if any. Here are some of the most important dates in that regard from the Estonian Tax and Customs Board’s calendar and their webpage:

The 15th of February marks the starting date from which declarations can be submitted electronically on the Estonian Tax and Customs Board website and on paper at service points across Estonia.

From the 26th of February, people who have submitted their declarations via the Tax and Customs Board’s website will start receiving their tax returns. This is of course if the person does not have to pay to the state.

From the 19th of March, the authorities will start transferring tax returns to people who submitted their declarations on paper at a service bureau.

The 30th of April is the official deadline for submitting your tax returns. This means that theoretically no declarations can be submitted after this date.

The 1st of October is the deadline for paying any remaining tax that you owe to the state, and for the state to pay out any overpaid amounts out to taxpayers.

Filing your income tax return

As mentioned before, from the 15th of February, you can start filing the pre-filled tax declaration electronically and the paper version can be requested and filed at one of the service points from the same date. Like the name “pre-filled declaration” states, some information regarding your earnings will already be there. It is up to you to check the correctness of the provided information and fill in the missing part. The pre-filled information comes from the tax agency’s database, which is made up by data from different sources like banks, statements of withheld and paid tax on your gross salary or compensation by your employer, etc.

A pre-filled declaration may already include the following:

- A bank account and the owner’s name;

- Information from your employers (taxable income payments, withheld income tax unemployment insurance contributions, funded pension payments, etc.);

- Dividends from which 7% income tax has been withheld;

- Temporary incapacity benefits (sickness, etc.);

- Pensions;

- Paid training costs;

- Gifts and donations;

- Pension insurance contributions;

- Data from the Estonian Central Register of Securities and the keeper of the pension register regarding transactions of the securities (excluding the acquisition costs of transferred securities and selling expenses related to the transfer);

- Income that is considered only in the calculation of the tax-free income (this may be dividends, equity contributions that are taxed at the company level, amounts received in the business accounts less the social tax).

What you should add to the declaration yourself:

- As a sole proprietor, you must fill in the form E;

- Information about income from abroad and expenses that you have paid abroad, which will act as deductions;

- Information about transfer of other property.

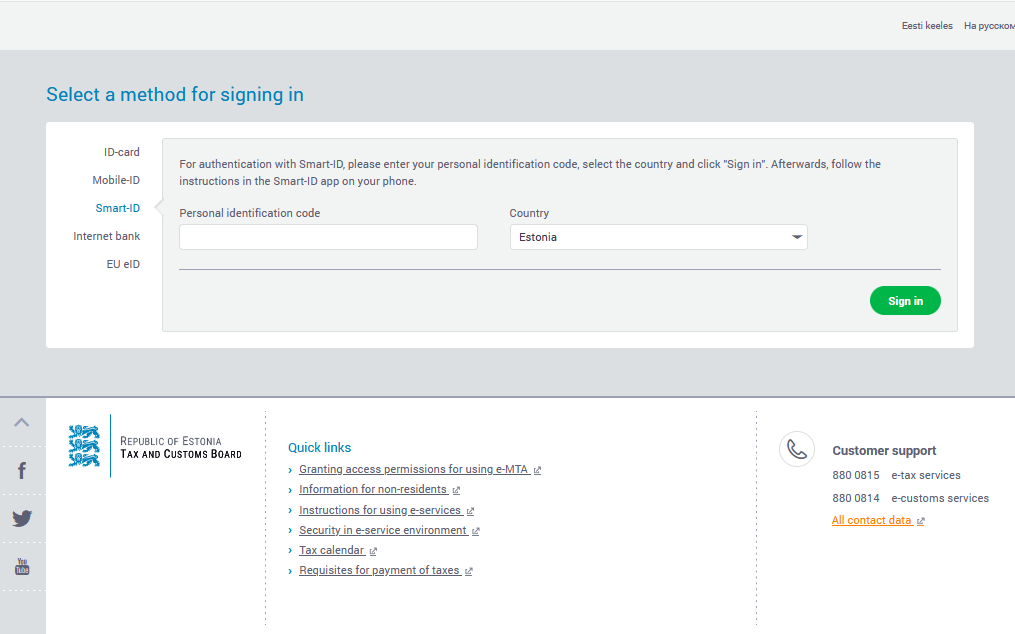

How to file an electronic income tax declaration

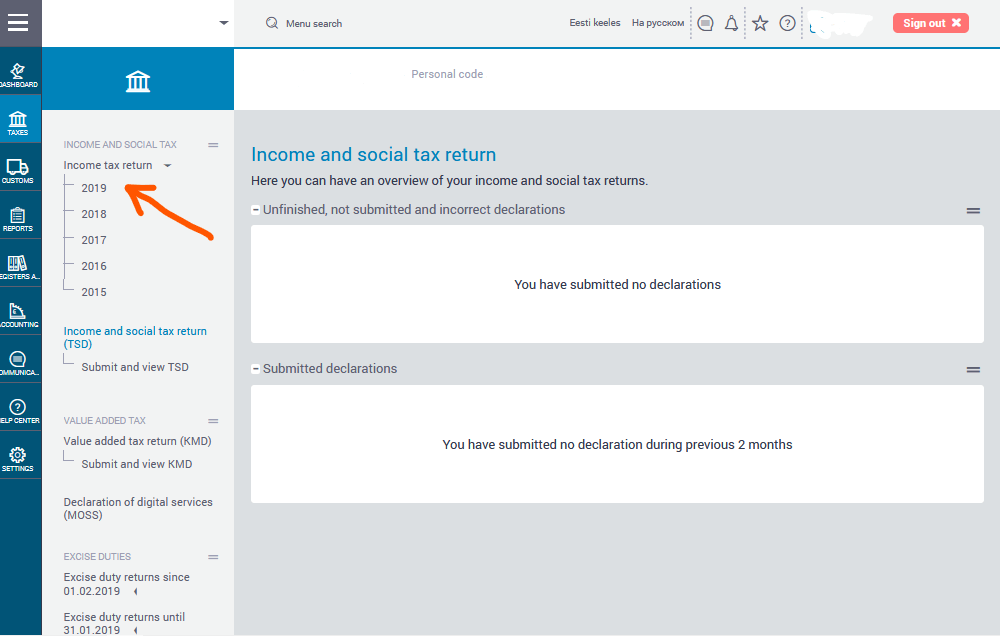

- Log in to the e-MTA website using your Estonian ID/e-Residency card, Mobile ID, Smart-ID, bank authentication or EU eID

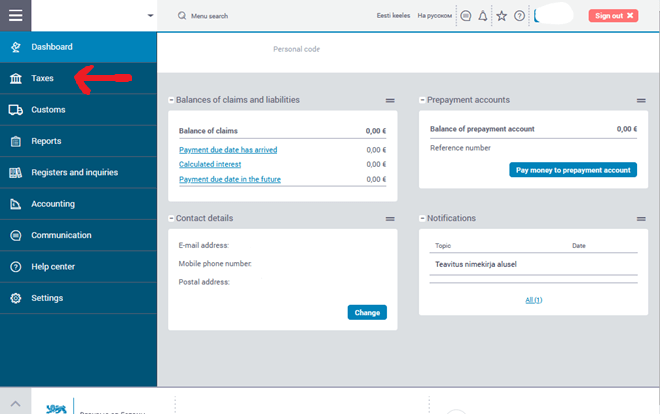

- Once you are logged in, select “Taxes” from the left-side menu.

- Then select the corresponding year for which you will submit your declaration under the “Income and Social Tax” section.

- Follow the instructions brought on your screen and start filling in the information. Note that all information must be written in Estonian, even so if you use the page in English or in Russian, and the currency used throughout is EUR.

- Once you have submitted your declaration, it will go through an inspection to determine if there is any additional information or documents that you must present to the tax office. In case there is a need for some clarification, you will be contacted by phone, email or physical mail.

You can always check the status of your electronic declaration once you have submitted it at the same location within the self-service.

Receiving your tax return

You can start expecting to receive a refund on your overpaid tax from the 26th of February if everything with your declaration is in order. In case there is some information you need to clarify; it will of course take longer. The refund itself will be made on the bank account that is brought out in the declaration that you submitted. The Tax and Customs Board have stated that they make tens of thousands of pay-outs at the same time and they are arranged based on banks. Therefore, some people may receive their returns sooner than others.

Paying due taxes

In case you declare your income and the state tells that you must pay them because some amount is missing, you should remember that you have until the 1st of October to pay them that amount. This long of a period should give enough time to work out a strategy to pay back the missing amount.

The amount should be transferred to one of these bank accounts where you must state the recipient as Maksu- ja Tolliamet:

| Name of the bank | IBAN number |

| SEB PANK | EE351010052031000004 |

| SWEDBANK | EE522200221013264447 |

| LUMINOR BANK | EE401700017002872300 |

| LHV PANK | EE957700771001523585 |

Every person who is liable to pay taxes will be appointed a personal reference number that will accompany any payment that the person has to make. To find your reference number, you must perform a search in the database based on your ID number or log into their electronic self-service.

Incorporate is here for you!

Filing for tax returns can be complicated, especially if you are doing business from another country or are new in Estonia and not very familiar with the local laws. That is why we consider it important to remind you that our experienced advisors and accountants are ready to help you with your personal and business needs with various services.

Also, please feel free to reach out to us via our contact form.